After bottoming at $1,206 per ounce on July 10, gold is at $1,286 this morning, a healthy 6.5% gain in just over one month.

The has been welcome relief for gold investors after a series of “flash crashes” on June 14, June 26 and July 3 contributed to a gold drawdown from $1,294 per ounce to $1,206 per ounce between June 6 and July 10. At that point it looked as though gold might fall through technical resistance and tumble to the $1,150 per ounce range.

But the new rally restored the upward momentum in gold we have seen since the post-election low on Dec. 15, 2016. Gold seems poised to resume its march to $1,300 after the paper gold bear raids of late June.

The physical fundamentals are stronger than ever for gold. Russia and China continue to be huge buyers. China bans export of its 450 tons per year of physical production.

Gold refiners are working around the clock and cannot meet demand. Gold refiners are also having difficulty finding gold to refine as mining output, official bullion sales and scrap inflows all remain weak.

Private bullion continues to migrate from bank vaults at UBS and Credit Suisse into nonbank vaults at Brinks and Loomis, thus reducing the floating supply available for bank unallocated gold sales.

In other words, the physical supply situation is tight as a drum.

The problem, of course, is unlimited selling in “paper” gold markets such as the Comex gold futures and similar instruments.

One of the flash crashes was precipitated by the instantaneous sale of gold futures contracts equal in underlying amount to 60 tons of physical gold. The largest bullion banks in the world could not source 60 tons of physical gold if they had months to do it.

There’s just not that much gold available. But in the paper gold market, there’s no limit on size, so anything goes.

There’s no sense complaining about this situation. It is what it is, and it won’t be broken up anytime soon. The main source of comfort is knowing that fundamentals always win in the long run even if there are temporary reversals. What you need to do is be patient, stay the course and buy strategically when the drawdowns emerge.

Where do we go from here?

August and September are traditionally strong seasonal periods for gold. This is partly due to proximity to the wedding and gift season in India, when strong buying prevails.

Yet there’s more to the gold demand story this year.

Deteriorating relations between the U.S. and Russia will only accelerate Russia’s efforts to diversify its reserves away from dollar assets (which can be frozen by the U.S. on a moment’s notice) to gold assets, which are immune to asset freezes and seizures.

The countdown to war with North Korea has begun. A U.S. attack on the North Korean nuclear and missile weapons programs is likely by mid-2018. The stock market may not have noticed, but the gold market has. This is part of the reason for recent gold strength.

Finally, we have to deal with our friends at the Fed. The strong jobs report on Friday, Aug. 4, gave life to the view that the Fed would raise interest rates at least one more time this year. Rate hikes make the dollar stronger and are a head wind for the dollar price of gold.

But the Fed will not hike rates again this year. Once the market wakes up to the reality of a prolonged “pause” by the Fed, they will conclude correctly that the Fed is once again attempting to ease by “forward guidance.” This relative ease will keep the dollar on its downward trend and be a boost to the dollar price of gold.

The Fed will not hike rates regardless of the strong jobs report. The reason is that strong job growth was “mission accomplished” for the Fed over a year ago. Jobs are not the determining factor in Fed rate decisions today. The determining factor is disinflation.

The Fed’s main inflation metric has been moving in the wrong direction since January. The readings on the core PCE deflator year over year (the Fed’s preferred metric) were:

January 1.9%

February 1.9%

March 1.6%

April 1.6%

May 1.5%

June 1.5%

The July data will not be available until early September.

The Fed’s target rate for this metric is 2%. It will take a sustained increase over several months for the Fed to conclude that inflation is back on track to meet the Fed’s goal.

There’s no chance of this happening before the Fed’s September meeting. It’s unlikely to happen before December, because of weakness in auto sales, retail sales, discretionary spending and consumer credit.

A weak dollar is the Fed’s only chance for more inflation. The way to get a weak dollar is to delay rate hikes indefinitely, and that’s what the Fed will do.

And a weak dollar means a higher dollar price for gold.

Current levels look like the last stop before $1,300 per ounce gold. After that, a price surge is likely as buyers jump on the bandwagon, and then it’s up, up and away.

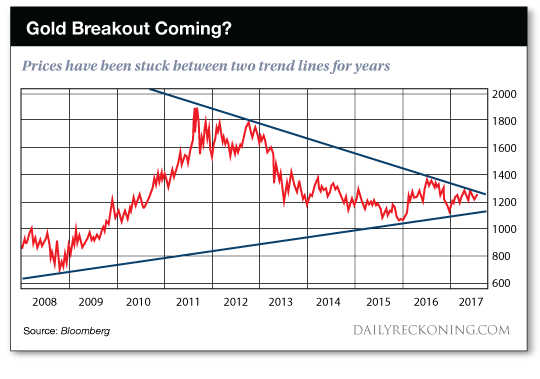

There’s an old saying that “a picture is worth a thousand words.” This chart is a good example of why that’s true:

Gold analyst Eddie Van Der Walt produced this 10-year chart for the dollar price of gold showing that gold prices have been converging into a narrow tunnel between two price trends — one trending higher and one lower — for the past six years.

This pattern has been especially pronounced since 2015. You can see gold has traded up and down in a range between $1,050 and $1,380 per ounce. The upper trend line and the lower trend line converge into a funnel.

Since gold will not remain in that funnel much longer (because it converges to a fixed price) gold will likely “break out” to the upside or downside, typically with a huge move that disrupts the pattern.

At the extreme, this could imply a gold price on its way to $1,800 or $800 per ounce. Which will it be?

The evidence overwhelmingly supports the thesis that gold will break out to the upside. Central banks are determined to get more inflation and will flip to easing policies if that’s what it takes.

Geopolitical risks are piling up from North Korea, to Syria, to the South China Sea and beyond.

The failure of the Trump agenda has put the stock market on edge and a substantial market correction may be in the cards.

Acute shortages of physical gold have set the stage for a delivery failure or a short squeeze.

Any one of these developments is enough to send gold soaring in response to a panic or as part of a flight to quality. The only force that could take gold lower is deflation, and that is the one thing central banks will never allow. The above chart is one of the most powerful bullish indicators I’ve ever seen.

Get ready for an explosion to the upside in the dollar price of gold. Make sure you have your physical gold and gold mining shares before the breakout begins.

- Source, James Rickards